One of the most encouraging aspects of the UK solar industry during 2021 was the emergence of a sustainable commercial rooftop sector. This article discusses the types of companies that have been planning new PV builds since the start of 2019, after feed-in tariffs were removed in the UK. The discussion and analyses are taken from the January 2022 release of the UK Solar Commercial Rooftop Opportunities Report.

There are many ways to analyse or segment solar rooftops: residential or non-residential; commercial or industrial; by size; by location; by building ownership status; by off-taker; by stakeholder’s business; by likely EPC and component suppliers.

Each offers a certain level of insight into the drivers behind new rooftop PV activity in the UK today, and one could rack up the blog wordcount by discussing them one after another.

For this piece, I have chosen to look at commercial rooftop investments by date of application (real investment) going live and then segmenting by building ‘type’. This choice was guided to a large extent by observations in the past couple of years that pointed to key trends happening in the market that were shaping the scale of the forecasted market size and were indicative of a less ‘binary’ split in commercial rooftop deployment that was witnessed during the former incentive years.

The starting point for this article was the January 2022 release of our UK Solar Commercial Rooftop Opportunities Report. We released this report at the end of 2021, focusing on commercial solar rooftop projects (everything above 100kWp dc) from the start of 2019 (when production-based incentives were phased out completely by the government).

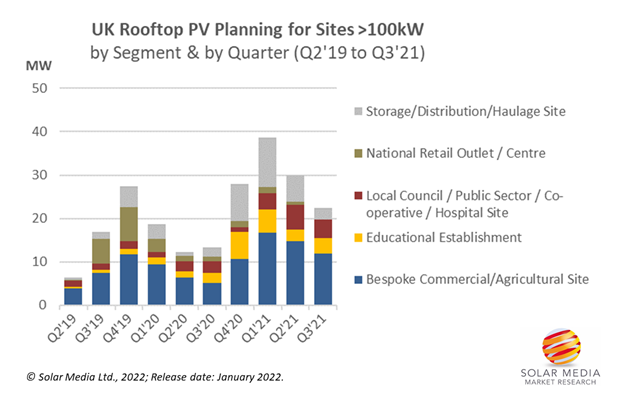

The January 2022 release of the report contains 603 new rooftop PV projects, adding up to 245MWp dc capacity. Within the >100kWp dc segment of the UK solar industry, this corresponds to more than 80% of commercial rooftop project undertaken in the past couple of years.

Our research team spent a few days last week looking in detail at this project list, and segmented these into categories that best captured the underlying growth trends within the market today. The results of this are shown in the graphic below, and discussed in more detail by me during the remainder of this article.

During the past 12 months, about 30MW of new commercial rooftop projects have been initiated each quarter, with a strong uptick in sites owned by local councils and educational establishments.

Let’s now review the information contained above.

The period under consideration is confined to Q2 2019 to Q3 2021 (inclusive). The start point (Q2 2019) is the first full quarter after incentives were removed in the UK. (For reference, commercial rooftop planning and buildout did see a surge at the end of Q4 2018 and the start of Q1 2019.) The end point (Q3 2021) reflects the last quarter fully audited by our research team.

Levels of rooftop activity have cycled somewhat in the past few years, with mid-2020 likely reflecting a downturn when the UK’s COVID restrictions were impacting on resources available for strategic investment initiatives. Otherwise, commercial rooftop activity can be seen to have evolved approximately from the circa. 10-20MW per quarter level in 2020 to 20-30MW in 2021. It is expected that this will move one notch higher in 2022; to about 30-40MW per quarter.

More interesting is the discussion on the segments described in the legend bar of the above graphic.

The main contribution is coming from the ‘Bespoke Commercial/Agricultural Site’ grouping. This includes commercial entities (often SMEs or subsidiary operations of overseas companies) whether the financing is coming from owned or third-party site ownership status; and from the continued investments from landowners (grouped as ‘Agricultural’ here). This sector is probably the most commercially savvy; decisions on solar PV investments are in part coming from having to show the outside world ‘green’ credentials, but are principally driven by balance sheet considerations and looking at solar yield returns as a function of initial capex outlay (ROI).

The next segmentation we chose to focus on is shown by the yellow bars in the graphic above, and categorised here as ‘Educational Establishment’. What a revelation for commercial solar PV in the UK over the past couple of years. Historically, PV installations on schools, especially - even when incentives were available - were largely driven by ‘educational’ purposes, and not necessarily for making money. In the past couple of years (post-subsidy), schools and universities/colleges are now looking at how solar PV generation can help them offset rising energy bills. The potential for growth is this segment is massive, especially when considering the number of large rooftops directly owned by UK universities.

Moving upwards in the bars within the graphic above, we now come to a fascinating grouping; councils, public sector entities, co-operatives and health/hospital sites/trusts. We chose to group these institutions together here because principally they fall under the same modus-operandi ‘umbrella’: do-the-right-thing; show environmental credentials; and divert funding to the local/domestic economy by way of infrastructure-related investments.

Many projects in the above two categories are qualifying for grants (capex incentivised) through the Public Sector Decarbonisation Scheme (PSDS), phase one of which saw funds allocated to support over 150MW of solar across almost 350 different local authorities and other public-sector entities in the UK.

The next category is labelled as ‘National Retail Outlet/Centre’. This segment represents some of the country’s largest chains, including in recent years Tesco for example, that have rolled out initiatives to have PV systems installed on most of its large outlets. Activity by these companies has tended to come in waves historically, but is expected to see more uniformity in deployment in coming years.

The final grouping is for the large storage and distribution centres, where some of the biggest rooftop installations are undertaken, often in excess of 1MW. Recently, there has been a strong uptick in PV being included at the initial build phase (new facilities) as opposed to the historic tendency to retrofit on existing buildings.

We have discussed in recent months on Solar Power Portal the prospect of more than 500MW being deployed on UK rooftops during 2022, when including both residential and non-residential segments together. Assuming about 150MW of this coming from the >100kW category (examined within the above graphic), this should be supported by about 35-40MW of new sites planned each quarter. The data for 2021 would tend to support this outlook.

To access monthly releases of the UK Solar Commercial Rooftop Opportunities Report, please follow the link to the report landing page and complete details for more information.