_.jpg)

Gridcog found that a 4kWp installation will mean a household spends ~£465/year on energy, a saving of £725/year. Image: Greens MPs (Flickr).

With power prices at record highs in Britain, the potential of domestic solar power has gained particular interest over the past year.

Installers are reporting record high interest, with many struggling to meet the demand they are seeing, as homeowners look to generate, use and sell electricity on their roofs.

In 2020, the Smart Export Guarantee (SEG) legislation came into effect, meaning that suppliers with more than 150,000 domestic customers were required to launch an export tariff. This is designed to support a competitive export market, both encouraging households to adopt renewable energy to reduce their bills and provide additional sources of clean energy to the grid.

There are 13 suppliers that currently offer SEG tariffs, with the highest tariff available from Octopus Energy at 15p/kWh for its Fixed Outgoing tariff.

But what is it like to have a domestic solar installation? Gridcog modelled an asset for Solar Power Portal, breaking it down to look at the details of a typical installation to demonstrate what the payback period would look like.

The specs

Gridcog modelled a 4KWp installation, oriented 180º south, tilted 30º, over a ten-year period from 1 January 2023.

The capex of an installation like this would be around £5,000, with the Energy Savings Trust suggesting residential installations generally cost between £3,500 and £7,300.

A derating factor of 89% was applied to the installation, along with an assumption of 0.4% degradation per year.

Currently, the unit price for electricity under a standard variable tariff is set at 34.0p/kWh inclusive of VAT under the Energy Price Guarantee, and the standing charge is 46.36p/day.

For its model, Gridcog looked at using the Octopus Fixed Outgoing tariff so 15p/kWh.

It’s worth noting that for a real-world installation you could expect SEG tariff to change over a ten-year period, for example the Octopus tariff doubled from its previous rate of 7.5p/kWh to 15p/kWh in September.

Gridcog’s model looked at a household with an annual consumption of 3MWh, just above Ofgem’s estimate for the typical household in Britain at 2,900kWh of electricity per year.

How much could solar panels save a typical household then?

In total, Gridcog found that the household's electricity spend within the baseline scenario is £1,190/year (£1,020 energy, £170 standing charge).

Self-consumption from the solar installation of a little under 1MWh reduces the cost of imported electricity to £865/year (£695 energy, £170 standing charge). The SEG tariff earns ~£400/year for the household, with the assumption of 2.7MWh exported to the grid.

Therefore the total energy spend for the household is therefore ~£465/year, a saving of £725/year.

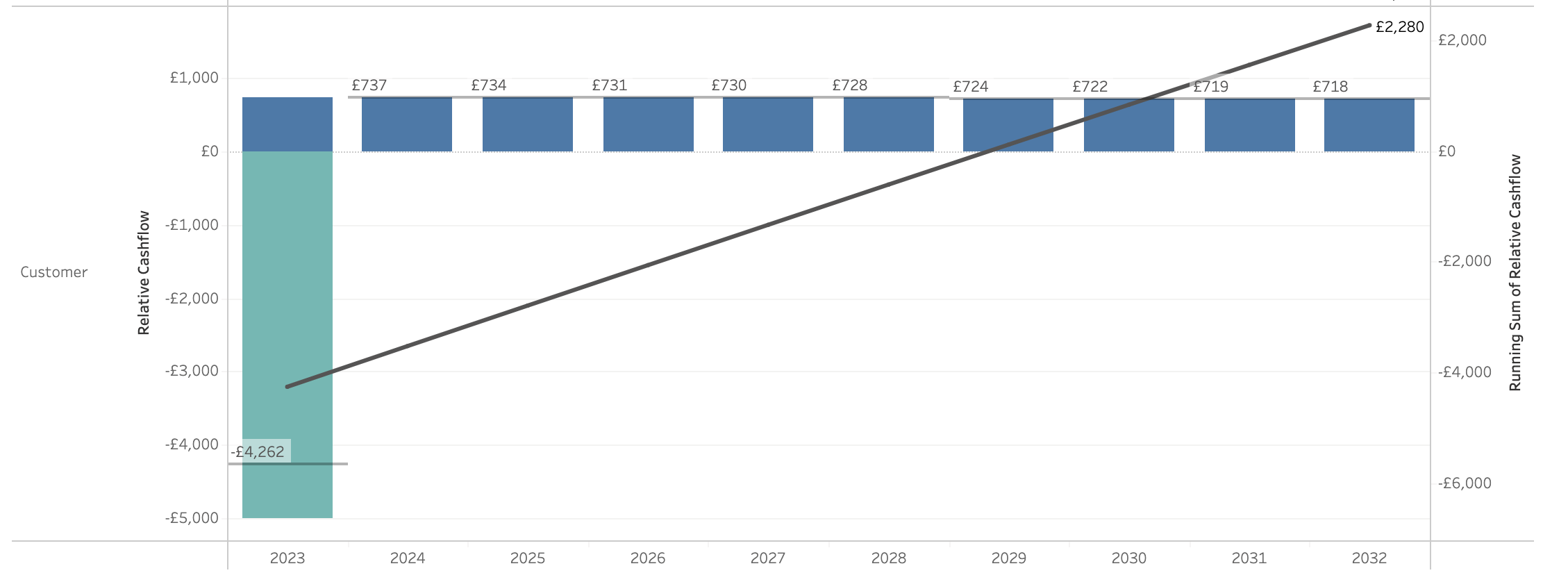

Relative cashflow compared to a baseline scenario with no solar. Image: Gridcog.

Under this model, and ignoring the cost of capital/interest for the time being, the payback period for this installation would end in September 2029, so 6.75 years.

Over the decade it was modelled on, the return on investment would therefore be £2,280, or 46%.

Depending on the size of the installation this will vary, for example:

- 3MW, £3,750 capex, payback in 6.5 years, ROI after 10 years of £2040, or 54%

- 5MW, £6,250 capex, payback in 7.25 years, ROI after 10 years of £2480, or 40%

This analysis fits with recent analysis from the Energy and Climate Intelligence Unit, which found that the payback time of rooftop solar panels is now just six years, meaning the average installation will provide effectively free power for 19 years.

Similarly, Solar Energy UK highlighted that amid the current high-price environment, combining a solar PV and battery energy storage system could see savings of around £40,000 over the system's lifetime for a standard mid-terrace house.

The addition of battery energy storage can further boost the payback period of an installation by providing further flexibility to the asset.

“If a battery storage system is added, the load can be shifted so more of the solar output is self-consumed. Whether this makes sense economically depends on the battery size/cost, load pattern, and the price differential between the energy import and export,” Gridcog noted.

“The case for the battery improves if the household has sharper price signals, e.g. a time-of-use tariff or energy prices that track the wholesale prices more closely.”