Over the next few months, our market research team will be hosting key events in the UK, explaining what the solar landscape in the UK will look like out to 2030, including factors that are driving growth forecasts and issues related to the supply of key components.

This article discusses the themes underpinning these issues. Further details will be outlined during a free webinar on 20 July 2022 that I will deliver online. To register, follow the link here.

Thereafter, the main event for stakeholders within the UK’s sector will be our flagship event in London – the UK Solar Summit conference – on 14 - 15 September 2022. Details on how to participate in the event (as a speaker, partner or attendee) are outlined on the event landing page here.

UK solar demand is part of a major global uptick in PV

At face value, it might look like the UK is unique and special, with its own set of solar ambitions and targets, stimulating post-subsidy growth metrics across residential, commercial rooftop and ground-mount segments.

While this is heartwarming to UK stakeholders, the reality is that the UK is just another country globally that has been subjected to a coming together of different environmental, social and financial drivers.

The pace at which this has happened in the past 24 months has been blistering. It is like a tsunami of demand for solar has hit the world, and the UK is now one of many countries and regions participating in this onslaught of demand, fighting for a finite supply of the most important part – the modules.

Perhaps what has muddied the waters within the UK is the history of solar in the country, and the start/stop phases dictated by the period of production-based incentives between 2010 and 2017.

It is all too easy to conclude that UK solar has gone through an isolated journey, starting with no incentives (pre-2010), lucrative incentives (2010-2017), phasing out of incentives (2017-2020), followed by locally-driven post-subsidy dynamics (post-2020).

Indeed, we have commented regularly over the past couple of years on the growth in commercial rooftop installations and the pipeline of utility-scale ground-mounted projects (now over 40GW).

But, ultimately, the UK does not manufacture products, and is at the whim of Asian supply, raw material price volatility and shipping costs. No slight here: China makes more than 90% of everything these days, and in some cases (for key parts of the value chain, including wafers used in cells) virtually 100%.

So, the UK is now in a fight globally to secure modules made in China (or by Chinese owned facilities in Southeast Asia).

It should be a nice problem for the industry: stratospheric demand in the absence of government hand-outs. But for now, it is a bun fight to secure product globally, and the entities suffering most are those seeking to fulfil gigawatt-plus portfolio build-outs in the near to mid-term.

There are just too many buyers! And over the next few years, many global utilities and corporates will fail to meet their declared goals (as part of net zero aspirations or corporate targets), simply by not getting enough modules.

As such, UK solar is contributing to the huge uptick in global PV demand, but is also subject to the frailties of being just another country controlled by external forces beyond its control.

Sadly for developers and investors (and especially those in the UK and Europe that did business in the past), the days of having buying power on the back of a single 50-100MW site - or indeed 1GW contracted volume of modules – are gone. To say it is a sellers-market today is a gross understatement.

All said and done, 2022 is a massive year for solar deployment globally. More than 250GW of modules will be produced and shipped, with more than 200GW going to commercial, industrial and utility sites. The goal for end users is to be part of this mix, and not one of many unable to secure supply.

The same type of landscape will likely unfold in 2023/2024. Anyone waiting for a return to former times, when module supply was in abundance and pricing was routinely falling, could be playing high risk stakes.

More than ever, the solar industry in the UK needs to understand that the boom in solar is not localised but happening everywhere globally.

Unlearning business practices from the UK’s first boom phase

During the interim period - after subsidies expired and the UK was adjusting to a landscape absent of government-backed production-based revenue streams - the world changed. By the time developers and installers had reset business models, demand had rebounded on the back of corporate ESG goals and net zero targets.

In the new normal today, solar module availability, performance and pricing is now substantially different to the first phase of UK solar deployment.

Simply expecting to have modules available at the drop of a hat is no longer an option. Predicting module pricing in 6-12 months has also changed; gone are the days of simply factoring in 5-10% annual price declines.

Module supply is no longer dominated by the previous go-to technology type that was common in the past, namely p-type multi panels (60 or 72 full-cell formats). PV technology is dominated by p-type mono PERC, and modules are now bifacial in design by default (owing to cells being made bifacial as standard). And lastly, module formats are now much larger, consisting of more cells (larger, up to 8 inches) and typically half-cut before module assembly.

The standard offering now for rooftops is close to 400W (mono-facial deployed, even if bifacial capable), with some larger rooftops using 540-550W panels even. For ground-mount, panels are usually 540-550W, with 580-590W versions (or above 600W) also being deployed.

This is the state of play in 2022. However, many solar farms in the UK will not be constructed for a few years. By this time, it is likely the entire industry will have shifted to even higher performing n-type solar panels, with an extra 30-50W single-side power rating (Wp-dc at STC).

Shrewd developers (and investors) now need to be designing models based on n-type bifacial deployment, something that can only assist in terms of reducing acreage and increasing yield.

Another changing dynamic relates to buying modules without having to undertake any great scrutiny on origin of manufacture or upstream supply chains. For years, the UK – like most end markets with the exception of the US – has been able to buy modules directly from China, with little consideration on the above-noted factors. This practice has now ended.

While the US is the only country actively putting anti-China measures in place (impacting on cells and modules being made in Southeast Asia, in addition to polysilicon issues relating to Xinjiang province), there is an underlying shift going on that is causing global solar buyers/owners/offtakers to be environmentally and socially ‘conscious’.

Given that 97% of module suppliers globally have no strong control over the wafers, polysilicon and mg-Si production/supply, it is a hugely important issue today. It is also a hugely complicated question, and one that I will discuss in more detail on the forthcoming webinar and at the conference in London in September. In short, however, a level of due diligence now needs to be undertaken when buying modules in the UK that was not in place during the first wave of deployment.

What is happening now in the UK solar market?

There are several drivers in the UK today that will likely push 2022 installations close to the gigawatt-level. This can be understood best by segmenting the market into various groupings: residential, public-sector rooftops, commercial rooftops (both occupier-owned and third-party owned/leased), public-sector ground-mount, and commercial/utility ground-mount. Here, I have used the ‘public-sector’ tag quite loosely to encompass academy trusts, water utilities, privately-owned care homes, NHS sites and other similar (or not-for-profit) entities.

Residential has a life of its own, with component supply going through distribution channels. The public-sector grouping above also follows this type of business model, with the exception of some of the larger ground-mount sites.

This leaves the major interest today within the UK solar sector coming from commercial rooftops and utility-scale solar farms. Each of these is now discussed below.

UK’s largest rooftop site planned for Boots Campus in Nottingham

Commercial rooftop solar activity in the UK is thriving, epitomised by the current plans by Boots (the Chemist) to install almost 7MW on their campus rooftops in Nottingham. While on this high side for a rooftop project, it is just one of hundreds of commercial installations being undertaken today or planned for the next few months.

Previously a hard sell to get corporates to install solar panels on rooftops in the UK, things could not look more different today. The reason? Corporate net-zero goals, 2030 targets, ESG branding, etc. But perhaps the biggest driver now is that companies can’t ‘afford’ not to have a net zero or environmentally-acceptable roadmap/plan to decouple their carbon footprint from legacy fossil fuel reliance.

Yes, there are other factors at play; decoupling from energy price volatility, investing capex today with a clear return on investment target, etc. But these are secondary to the potential loss of company branding (or share price impact) by not being on the right side of environmentally-friendly public perceptions and expectations.

So, what we see now in the UK (and during the past 12 months) is a rush to get planning approved for commercial rooftop space. Everyone is active here, from major nationwide retailers and car showroom premises to bespoke commercial units and agricultural buildings. Each month, the number of planned sites grows. It is indeed a bounty time for the UK solar installer, with almost no concerns over lumpiness in business that historically hit working capital and led many to incur unmanageable debts.

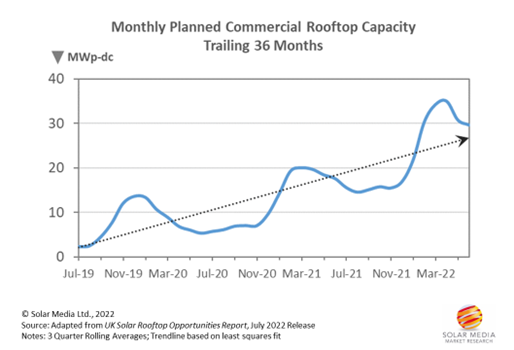

The graphic below shows this trend clearly; the planned commercial rooftop capacity by month (adding up individual sites above 100kWp-dc), going back to three years to mid-2019, after FiTs had expired.

Monthly planned rooftop installations of >100kWp-dc have been increasing significantly since FiTs expired at the start of 2019, trending now at about 30MW per month

Ground-mount planning at record levels with mega-solar grabbing the headlines

Since ROCs expired in 2017, the ground-mount sector has been the subject of considerable new site planning. This has seen the pipeline of potential projects grow from just a few gigawatts at the start of 2019 to over 40GW today.

This 40GW figure is comprised of many early-stage applications (screening or scoping requests), both at the local planning authority level (LPA) and, for larger projects, falling under NSIP or Scottish/Welsh government departments.

A key part of this 40GW total is coming from ‘mega-scale’ projects, as high as 500MW or above in some cases. Currently, there is about 17GW of capacity under this category, and the media is full of discussion here. This is not a surprise.

On the one hand, some may argue that these large site proposals are just a natural consequence of solar being scaled beyond the legacy LPA threshold levels, meeting a key part of the UK’s long-term net zero targets. However, there is also a danger that the sheer scale of these projects could be to the detriment of ground-mounted solar growth going forward.

It is an incredibly difficult topic to predict. We have all seen how much public opinion can influence policy making, and for example, how this impacted the onshore wind segment in the past few years. One should never forget that, at heart, everyone exhibits some NIMBY traits. The only saving grace today in the UK is that most politicians now have more pressing matters to deal with in terms of staying in office, than making a pledge to safeguard land against any form of industrialisation.

However, it should be obvious that planning a large project somewhere in the home counties, and in the backyard of a prominent cabinet minister (whoever they are at any given time!) is perhaps not a good move. On a more serious note, it would be catastrophic for the entire sector (LPA designated or not) if there was then a backlash that affected everyone by way of changes to planning legislation.

Of the 17GW of projects that fall under this category, it appears that only one is moving ahead currently, gradually discharging pre-build conditions after planning had been approved. This is the Cleve Hill site in Kent, probably the first to hit the NSIP stage in England. By all accounts, this does look like being the first mega-solar project to be built in the UK in the short-term.

It should be noted that many of the projects comprising the 17GW capacity are nowhere near as advanced as Cleve Hill. The majority in fact are pending any full planning application (NSIP or Scottish/Welsh government level). A bunch are also simply placeholders for contracts for Transmission Entry Capacity (TEC) and exist only at the SPV level.

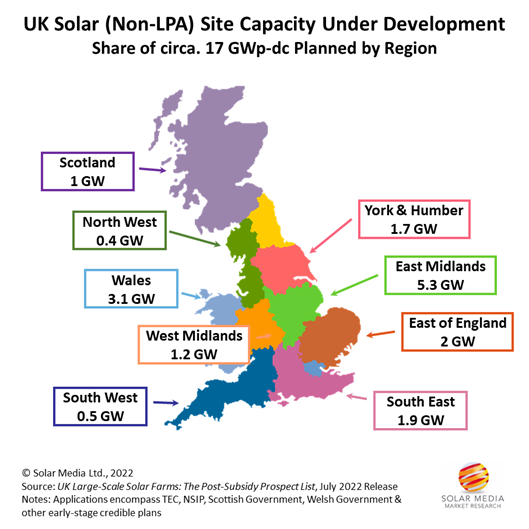

The graph below shows the geographic split of this 17GW. About 4GW falls under the remit of the Scottish and Welsh governments, with the 3GW in Wales at a more advanced stage than in Scotland. The remaining 13GW is spread across England.

Large-scale solar farms under planning that fall outside LPA remit are mostly located across the east of England, driven by capacity being freed up by coal-power substations coming offline.

Half of the 17GW across the UK is located across the East Midlands, the East of England and the West Midlands, with the East Midlands by far the most prominent. This focus on the East Midlands is driven by capacity freed up from three decommissioned coal-fired power stations: West Burton, Cottam and Drakelow. This accounts for much of the mainstream press coverage relating to some of the solar projects planned across the East Midlands and the East of England, and leads me on to the final topic of discussion within this feature: making the case for large-scale solar in the UK.

Getting the public on board

Before getting on to some of the current factors driving public acceptance of large-scale solar in the UK, one really has to flag up that this is not a new issue in the UK; it is just that some of the players currently planning solar farms in the UK are ‘new’ to the game and may not be aware of what has been done before during the first wave of solar farm build out (mainly under ROCs).

When solar farms became a reality in the UK (albeit at the 5MW level under FiTs back in 2011), a subset of developers prioritised public engagement early on in the planning process. There was no better example of this than Lightsource (then pre-BP affiliation): their consultations at the local village hall level truly set the bar in terms of clarity and disclosure to the local communities. If anyone is capable of compiling a guidebook in terms of public engagement for UK solar farms, it is Lightsource BP.

Many others tended to take a more gung-ho attitude, either driven by a desire simply to flip pre-consented sites (whether or not truly shovel-ready with funds) or perhaps seeing the public buy-in as a luxury that if avoided, would save lots of time and effort. Sadly, this practice has not gone away.

But the good news is that the UK has more than 8GW of solar farms built and operational today, and surely a review of public perception on these and the impact on the environment and communities involved would be one of the most valuable resources in terms of the current pipeline of projects at the planning stage.

Today, we can see a new drive to address the public perception question again. It does appear somewhat that the industry is forgetting what was done in the past, or maybe the current players (or people) are not aware of this?

It could be that the stakes are higher. Not just in terms of the project sizes (with all the large sites within the 17GW above being well above anything build in the past) but the type of players now engaged at the early planning stages.

In the first wave of solar farm builds in the UK, site evolution followed a different path. Broadly speaking, developers did the initial planning work, then flipped to a short-term owner that brought in the funds to build, and finally the built site was offloaded to a long-term institutional owner. As such, the final owner had little or no involvement during the planning stages, and focused only on site returns and asset management of a multi-site portfolio. Solar farms had become operational assets; or somewhat abstract infrastructure funds that made money when the sun was shining.

Now things are completely different, and this is not just within the UK but globally when it comes to solar and renewables.

Long-term owners are now active at the planning stage, mostly driven by the need to control the quality of build and avoid paying over-the-odds for projects auctioned off to the market by short-term players or EPCs with a financial backer.

The other big difference today relates to the make-up of the companies behind the overall 40GW of project pipeline within the UK, and the involvement of global utilities that have gone on record with renewables targets, both globally and within the UK. For these organisations, there is more at stake than simply getting involved to control site build quality and save a few pennies by not having to buy completed assets. Having the public on board is critical from an entire business perspective, not simply relating to the solar part within a renewables operating unit.

For some, having public buy-in for new solar sites in the UK is essential, as it could overlap with a low carbon marketing focus that lumps together nuclear, wind and solar energy supply contributions to the UK market. Therefore, it is not just a luxury to have people on board with new solar plans, but an absolute necessity. This same public voice may end up being strong for other offshore wind farms or new nuclear plants being proposed at the government level within the UK, for example.

Perhaps the fact that BP falls into this global utility grouping could be the salvation for the UK solar sector, with Lightsource-BP still active in new solar planning in the UK, and as noted above, with Lightsource having been the stand-out player during the first wave of solar deployment in the UK. The only caveat here is that Lightsource-BP is now more active outside the UK, and has a global mandate within BP; so the UK market is no longer the sole focus of the company. But maybe there is value to using UK case studies as part of global marketing collateral – who knows.

Keeping abreast of UK solar in the coming weeks and months

As stated earlier, we have a couple of events soon that will offer greater insights into the UK’s solar build-out (both commercial rooftop and ground-mount sites) over the coming years.

I will deliver a webinar online on 20 July 2022, addressing many of the issues covered in this article. To register, use the link here. I will touch on a bunch of other demand factors in the UK this year.

The main UK solar event – the UK Solar Summit conference – takes place on 14-15 September 2022 in London. Details on how to participate can be found here. The agenda is full of topics related to large-scale commercial and ground-mount growth out to 2030.