Applications for the long-awaited Renewable Electricity Support Scheme (RESS) in the Republic of Ireland have now closed and many people in the industry are waiting to find out the results.

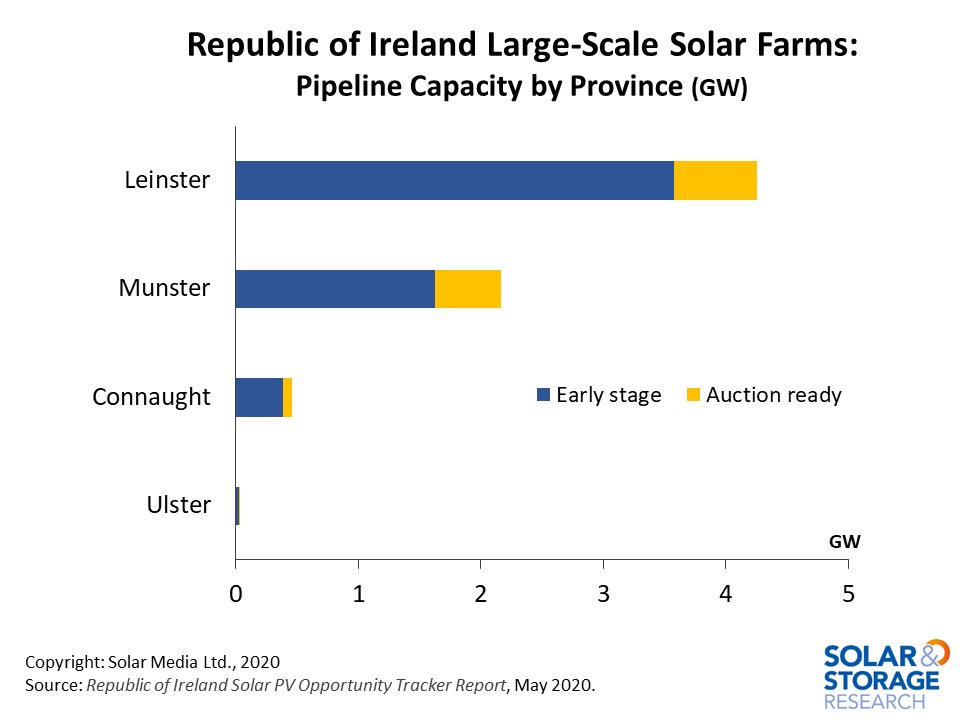

The total pipeline of projects in the Republic of Ireland has now reached nearly 6.9GW, with approximately 1.3GW of projects eligible to participate in the first round of the auction.

The successful projects will then be part of the first phase of ground-mounted solar construction in the Republic of Ireland.

In recent weeks we have learnt more about the projects that have been submitted and the companies who have entered the market with acquisitions by ESB, Statkraft and Obton/Shannon Energy announced most recently, alongside indications given of the size of the portfolios submitted.

While we wait for the results of the first auction, this article will take a closer look at the projects in the pipeline and where they are located.

The graphic below shows which provinces the proposed solar projects are located in. We can see the total capacity of projects in each region; the yellow section shows the capacity from that region that was eligible for the auction.

Solar farm pipeline in the Republic of Ireland, by region and auction-ready capacity.

The largest number of projects are located in the South and East of Ireland. This is not surprising as it coincides with the areas with the highest irradiation levels and the areas with higher population density and therefore demand for electricity.

Looking in more detail, the analysis shows that Wexford and Meath have the highest number of proposed solar farms, closely followed by Cork. When we break it down further, we see that Meath and Waterford have the largest capacity at the auction ready stage but Cork has the most projects. Meath and Waterford have a larger average project size with both counties having several large projects of over 80MW, whereas Cork has an average project size of under 10MW.

The project sizes are important when looking at the potential results of the auction. We know there is a carve-out for solar with a maximum of 300GWh – equivalent to around 300MW – in the first auction.

If we assume that the largest solar projects can benefit from economies of scale, it is likely that these projects will be able to bid at a lower price; meaning, if they are successful, the capacity could be taken up by a relatively small number of projects, leaving the remaining smaller projects in the auction to compete against other technologies, including onshore wind.

However, the acquisition of large portfolios in recent month suggests that the developers have considered this risk and, by entering the portfolios, they are able to benefit from the cost reductions across the portfolio.

The location of solar farms and wind farms takes on new importance when we look at the emergence of battery storage in Ireland. One of the stated aims of the DS3 programme “is to meet Ireland's 2020 electricity targets by increasing the amount of renewable energy on the Irish power system in a safe and secure manner.” This means that the locations of new renewable generation will influence where the system services are required and where storage can help offset the need for grid reinforcement around substations.

The Republic of Ireland Solar PV Opportunity Tracker Report from the Solar Media Market Research team includes details of all the planned solar PV projects in the Republic of Ireland, identifying the auction ready projects in addition to a further 650 projects at various stages of development. The report provides the company and location details for each project as well as information on planning and grid connections. For more details on how to access this site-specific report, please contact us here.