.jpg)

"The most encouraging segment seeing strong deployment in the UK today must surely be the large commercial space," writes Colville. Image: Scott Webb (Unsplash).

During the first six months of 2022, the UK posted 80% growth in new solar PV installations compared to the same period last year, with 556MW of capacity installed. This article explains the factors driving this growth and what can be expected for the rest of 2022 and into 2023.

Further details will be covered in Solar Media’s forthcoming webinar next week on Wednesday 20 July; details on how to sign-up to the webinar can be found here.

A reminder also that Solar Media will be hosting the UK Solar Summit event in London on 14-15 September 2022; to attend or be part of this two-day event, follow the links at the landing page here.

Growth across all key segments

The most general segmentation of the UK market is across residential installations, small commercial rooftops (<100kW), large commercial rooftops (>100kW) and ground-mount (dominated by utility-scale solar farms). The key segments driving current growth are coming from residential, large commercial rooftops and ground-mount sites.

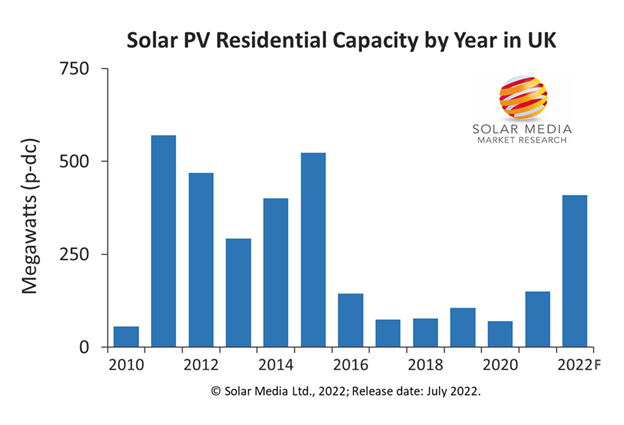

Residential is seeing huge growth today, with the sector fully recovered from the reset that occurred at the start of 2019, when FiTs ended. New builds form the basis of this market recovery. The graphic below illustrates this clearly.

The residential segment in the UK is growing at a phenomenal rate, and is almost approaching levels last seen when FiT rates were 22p/kWh back in 2012. Image: Solar Media.

The industry is still well below the bounty year of 2010 when FiTs were first introduced at 42p/kWh, causing a landslide of privately owned, domestic PV installations. Gradually, the volumes declined as FiTs were phased out to the start of 2019. Thereafter, the growth has been constant, with the exception of a pause for a few months at the start of 2020 caused by COVID working restrictions.

Currently, the residential sector is trending north of 100MW per quarter, and there appears to be no slowdown in growth. At this point, we are forecasting residential deployment in 2022 to reach about 400MW.

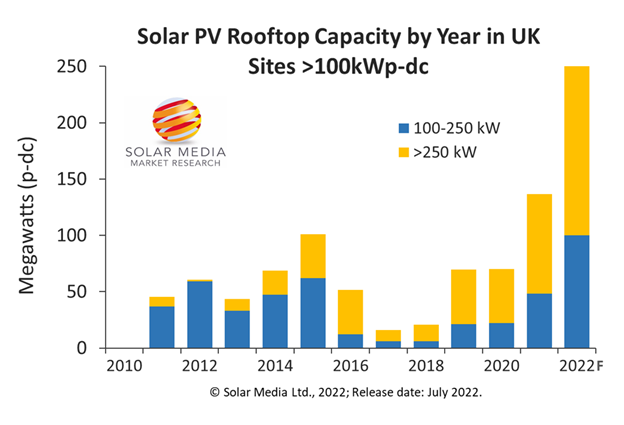

The most encouraging segment seeing strong deployment in the UK today must surely be the large commercial space, a market that never managed to gain any traction in the past. The reasons for this, as discussed previously, include that while there was a general lethargy in the market before 2020 (attributed then largely to incentive step-downs occurring faster than commercial rooftops could be enabled), the main reason for the new impetus in the commercial rooftop space is coming from environmental and sustainability targets set by corporates (aided by securitisation of energy supply).

The graph below looks at quarterly growth in the 100kW-plus commercial rooftop market. Behind this growth in installations is a vibrant new planning trajectory, discussed in more detail in a recent article on Solar Power Portal.

The commercial rooftop market in the UK is undergoing explosive growth, up more than 135% during the first half of 2022, compared to installations during 1H’21. Image: Solar Media.

The ground-mount utility sector is still the segment of the market that will be the largest contributor in coming years, in terms of new capacity added. This was true in the past, before major utilities (such as EDF, Statkraft and ScottishPower) released massive investments into the market, before the UK had reprioritised renewable energy contributions and net-zero targets, before the war in Ukraine that spooked the world in terms of short-term energy security and before the announcement last week that 2.2GW of new solar PV had been successful in the recent CfD Round 4 auction.

All these factors only add to the hunger and desire to deploy large-scale solar in the UK over the next decade. The question is: how much and how soon?

It only takes a handful of 50MW sites being built to quickly add new capacity levels, and this is what has been happening (all subsidy-free) during 2021 and 2022. The build process here has been somewhat lumpy over the past few years, and much of it below the radar, but there has been a steady flow of new subsidy-free (private PPA secured) solar farms added.

Clearly, the new capacity allocated under CfD Round 4 now provides a baseline of capacity, but there has been a huge amount of consented site conditional discharge underway on 20-50MW sites during the past 12 months (over and above the new scoping and full planning applications). As such, there is significant capacity that could be added on the ground before the end of 2022. However, most of the sites do not have time constraints so could easily be carried over to 2023 if component availability or costs don’t look attractive in the near term.

Market size in 2022 and 2023

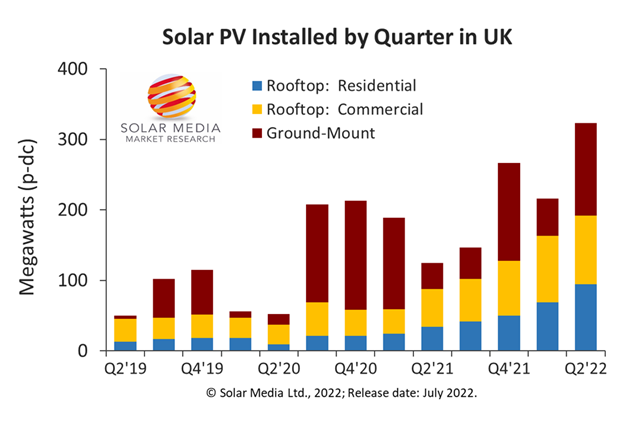

Before we look at the market for 2022 and 2023, let’s review the overall quarterly capacity added up to the end of Q2’22 (30 June 2022).

During the subsidy-free phase in UK solar, from Q2’19 onwards, there has been strong growth across the key residential, commercial rooftop and ground-mount sectors. Image: Solar Media.

The final market size for 2022 will depend on how many of the subsidy-free 50MW sites are done between now and year-end. This is impossible to know, and the figure could be anywhere from 250MW up to 750MW.

However, it is important to get a marker out there. For this, we are now working off 800MW rooftop and 500MW on the ground, for an overall market size of 1.3GW. This probably has an error bar of 15% on the low side and 10% on the high side. So the final deployment level for 2022 could be anywhere between 1.1-1.4GW. We will have better clarity on this when we release the Q3’22 numbers during October 2022.

Going into 2023, rooftop is likely to grow at about 30% Y/Y, and the ground-mount sector could easily get to 1GW. Combined, we have a market of 2GW for 2023 and this could well be on the low side if anything.

Any way you look at it, the UK solar industry is well on the way to sustained GW-plus of new capacity being added each year going forward. For sure, other curveballs will be thrown into the mix going forward: some negative and some positive. But assuming no major roadblocks, the UK could easily settle into a 2-3GW per annum market during 2024 and 2025.