.jpg)

The UK solar market is expected to exceed 1GW by the end of 2022. Image: Andreas Gücklhorn (Unsplash).

The UK solar industry is currently going through a dramatic change in fortunes, having recovered fully from the shock created by the ending of the production-based subsidies (FiTs and ROCs) during 2017/2018. During the first half of 2022, more than 0.5GW of new solar was installed, and this is likely to exceed the 1GW level by the end of the year.

The short-term focus is now on how much will be installed next year, and the very real prospect of the UK hitting the 2GW level during 2023, even before the impact of the recent CfD Round 4 sites are realised.

But all the leading indicators in the UK solar sector today are hinting at a far greater end-goal: 40GW of cumulative deployment by the start of 2030.

In this article, I outline how this 40GW of cumulative capacity could become a reality by 2030, looking in detail across all market segments and where the extra 24.2GW of capacity could be added during the seven year period from 2023 to the end of 2029.

Also discussed throughout the article are the key themes that will dominate the first UK Solar Summit conference, taking place in London on 14-15 September 2022. The agenda for the first live staging of this event includes a compliment of guest keynote speakers, each giving extended live presentations.

The speakers have been chosen from some of the major companies that are set to invest, deploy and benefit from the £25-30 billion that is expected to be spent on new solar capacity built in the UK during 2023-2029. More details on how to get involved in this conference (speaking and attending) are outlined at the end of this article.

All market segments are in growth mode

Perhaps the most exciting dynamic in the UK solar market today is the contribution coming from all segments of the market, across different rooftop and ground-mount activities. In terms of establishing a robust market, this is key, as there will always be periods or seasonality issues that cause temporary slowdowns in some of the subsegments.

Aside from the deployment levels now, the other encouraging sign relates to the pipeline of proposed/planned build-outs, both on rooftop and utility-scale ground-mount sites. In fact, growth here is by far outstripping the uptick in installations seen over the past 12-18 months.

It is important to look at all the subsegments of the market. Within each of these, there are different market drivers and different stakeholders (financing, suppliers, installers, off-takers, etc.). While some component suppliers (a handful of module and inverter companies) play across all segments, most tend to focus on either rooftop or ground-mount, residential or commercial, public-sector or privately-financed, etc.

The following sections now outline growth forecasts for rooftop and ground-mounted solar in the UK out to the end of 2029.

Rooftop solar market in the UK out to 2030

The rooftop market has two generic subcategories: residential and non-residential (commercial and industrial, sometimes referred to as C&I). The residential is then split into new-build and retrofit, based on the build-status of the property. Non-residential rooftops are best categorised by size; the differentiation in nomenclature between commercial and industrial is somewhat tentative.

Splitting out non-residential rooftops by size category of installation can be done in different ways. In the former days of FiTs (and to a lesser extent rooftop ROCs), different production-based incentive bands largely formed the commercial rooftop sub-segments (<4kW, 4-10kW, 10-50kW, etc.).

It is more pertinent however to divide up the commercial rooftop bands by site ‘type’, and in particular looking at the financing or business models driving this part of the market. Here, there are a few things to consider: owner-financed or third-party investments; public or private-sector; single-site premises or nationwide outlets/sites occupied/owned by the same entity.

Indeed, it is useful even to broaden out the traditional meaning of public-sector to include other segments that operate in a similar way, but are not, per se, generating finance (or receiving capex incentives) from the public purse. Within this grouping, we have many options today: NHS trusts, universities, water utilities, academy trusts, care homes, etc.

Almost all of these rooftop segments are in high-growth mode today, some more so than others. In fact, the only subsegment that is awaiting a rocket booster is the retrofit residential segment – the part of the UK solar industry that propelled initial growth in the sector back in 2010 when FiTs were first introduced.

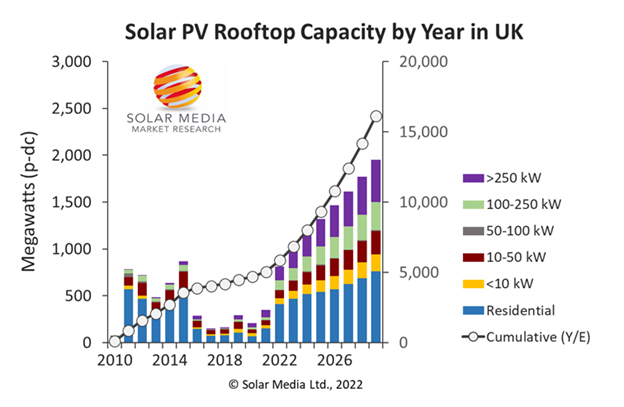

Let’s look now at rooftop UK solar deployment in the UK; historical back to 2010 (actuals) and forward to the end of 2029 (forecast). This is shown below, where the bars split out the segments into residential and different rooftop size bands reflecting the various drivers discussed above. In coming months, we will seek to split out residential into new-build and retrofit. Shown also in the graphic (solid curve, vertical-axis to the right) is the cumulative rooftop capacity figure at the end of each year.

The rooftop PV market in the UK moved into a new growth phase in 2022, driven by a rebound in the residential market and the emergence of the large rooftop segment for the first time. Image: Solar Media.

During the next seven years (2023 to 2029, inclusive), the above graph points to 10.3GW of new rooftop capacity to be installed, split across 4.2GW of residential and 6.1GW of commercial/industrial. This may indeed turn out to be on the low side if anything, such is the untapped potential yet to be realised with rooftop PV, in particular the retrofit residential segment.

The rooftop PV market (in contrast to the large utility ground-mount segment discussed later) is almost risk-free in terms of deployment certainty. Everyone seems to be fully supportive of rooftop PV: government departments, MPs, local councils, the public as a whole, and of course the entities (homeowners, rooftop proponents, new building stakeholders) that are injecting the capital and making the case for panel additions.

Ground-mount solar market in the UK out to 2030

The ground-mounted segment in the UK has been the largest contributor (63%) until now, in terms of getting to the 15.8GW of cumulative capacity level forecast by the end of 2022. This should continue to be the case out to 2030 (estimate 60% by the end of 2029), but here we have far more caveats and risk factors to consider.

It is also the part of the industry in the UK that has more money on tap for investment than it knows how to deploy in the short-term. This money is being lined up by a broad range of stakeholders, many of whom are part of a new global landscape in which there is a mad rush to secure newly-built utility-solar plants to fulfil company/shareholder/fund mandated 2030 net-zero goals. The world has quite literally gone mad for solar PV now.

Set against a backdrop of finite solar module availability out to 2030, this new supply/demand dichotomy is now creating a subset of solar asset owners that will succeed in getting their investments realised (by way of new owned solar farm capacity) and those that will inevitably lose out (not getting module supply on time). This is an altogether new dynamic that has been introduced to the global solar industry over the past 12-18 months and will certainly continue for years to come. A more detailed discussion on this will be reserved for one of the two extended keynote presentations I will give at the UK Solar Summit on 14-15 September in London.

Let’s look now at ground-mounted solar capacity in the UK, forecast out to 2030.

Segmenting all ground-mount capacity is best done by site size, and nothing else. The vast majority of existing and new ground-mount capacity is dominated by solar farms, as opposed to small arrays in back gardens or similar locations.

Utility solar farm size bands have evolved over time in the UK. During the early days of UK solar, sites were 5MW mostly (2011-2012) with FiT limits defining this scale. When ROCs were accessed by the industry, sites in the range 30-50MW were common, limited here by the 50MWp-dc limit in place then at the National Grid planning stage.

Fast-forward to 2022 (including the landscape that looks set to prevail in the near to mid-term), and utility solar farms have different size bands of interest.

There is a new evolving push for sites in the range 5-20MW (approx.) coming from ‘public-sector’ and landowner investments, falling outside the usual private/institutional vehicle route. However, more than 95% of existing and future capacity falls into the more prescriptive cash-flow process (and asset-owned) category, driving new solar farm deployment at the 50MW (and above) site level.

In this respect, there are basically two sub-segments of utility ground-mounted solar to consider: sites up to 50MWac (no longer peak-dc defined) and ‘larger’ sites whose size dictates that planning has to be granted by national or devolved government departments (that have different threshold criteria). By far, the most ambitious deployment levels here (including individual solar farms in the range 500MW-to-1GW) are falling under the auspices of the UK’s Planning Inspectorate that decides on new energy Infrastructure Projects deemed to be Nationally Significant (so-called NSIPs).

All major infrastructure projects in the UK have a subset of risks; choose from any recently-debated projects (Hinkley Point, the HS2 high speed network, the Cambo oil field in the North Sea). They have - and always will - divided political and public opinion and undergo phases of apparent wholesale support through to full-scale objection. Major spending always divides opinion.

Constant challenges also go hand-in-hand with changes to land-use; new housing developments, retail parks and – of course – any use of land for new energy production (green, nuclear, etc.).

Therefore, it should not come as any great surprise that there are more hurdles to overcome when it comes to deploying large-scale solar farms (the 50MW sites and any of the much-larger NSIP-type projects), more voices of objection, and consequently greater risk than the rooftop market outlined above.

This entire topic is a massive deal right now. However, large-scale solar farms have many proponents and the question of whether or not there is a need from an energy-independence perspective is no longer debated. But it is an area where the public needs to be taken along in the journey; the ultimate factor that will influence what policies and narrative politicians promote to stay in power or get (re)elected.

The forthcoming UK Solar Summit is going to address this issue within an industry forum for the first time on 14-15 September in London. Therefore, I will pause on this topic for now within this article, but definitely encourage you to come to London in September to hear what the sector now needs to do collectively to set out best-practices for everyone involved.

Let’s focus now on what the ground-mount deployment could look like out to 2030. Of course, there is more risk here when it comes to forecasting, as discussed above. But the prevailing wind does suggest that strong build-out of large-scale solar farms will be undertaken over the next seven years, even if there are bumps in the road along the way.

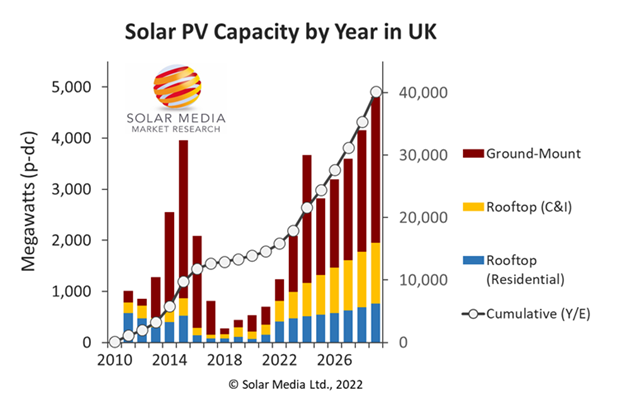

The graphic below shows the expected trajectory for new ground-mount PV in the UK to the end of 2029, alongside the residential and non-residential contributions outlined in the previous section of this article. The secondary vertical-axis shows the total (rooftop and ground-mount) cumulative installed PV capacity in the UK, illustrating the route to exceed 40GW by the start of 2030.

New ground-mount solar PV during 2023-2029 is expected to contribute about 14GWp-dc of new capacity, pushing year-end overall (rooftop and ground-mount) levels to just over 40GW by the start of 2030. Image: Solar Media.

While there are very real challenges for some of the sites in planning today, there are more positives at play than concerns at the individual site level (or indeed any transitory rhetoric that may prevail in the current Conservative Party leadership contest). These underlying positives therefore form the basis of the growth forecast above out to 2030. In this respect, we could also be looking at an upside scenario here that could easily unfold in the course of time; such is the rate of change of policy-makers, energy-supply dynamics and public climate-change thinking within the UK.

Further confirmation of sustained GW-plus annual deployment of solar farms is coming today from the massive pipeline of unbuilt projects (where significant capex has already been invested to get sites to ‘shovel-ready’ status). The overall pipeline now for solar farms is in the range 45-50GWp-dc, encompassing sites yet to submit a full planning application, those that have been submitted and are awaiting decision, and those approved and pending build-out or final completion/grid-connection.

And of course, within this 45-50GWp-dc, we have the 3GWp-dc of PV projects that were successful in the recent CfD Round 4 auction. Given that solar PV should be involved in ongoing CfD auctions, the government/CfD-supported portion could be dominant, especially if we factor in that NSIP projects are themselves effectively ‘government-backed’ also.

As of today, there is approximately 9GW of approved solar farm capacity that could easily be built in the next three to five years. This is key when looking at what would be needed for the UK solar sector as a whole to hit the 40GW mark by the end of the decade.

The graphic above shows that an additional ground-mount capacity of 14GW is required to get built in the seven year period including 2023 to 2029 (inclusive), to reach the nominal 40GW cumulative level.

If, as discussed above, we assume that 8GW (of the 9GW approved right now) is effectively rubber-stamped (planning approved, grid-connection agreed), then it only needs a further 5GW of additional sites to be approved and built over a seven year period. This is not difficult at all, and could even be done by increased contributions coming from sites rated at about 20-30MW in size, if there are any restrictions imposed on the mega-sized projects or by way of land-use changes.

Therefore, one should maybe not get too distracted with some of the public campaigns at large and highly localised around a bunch of coal-fired power stations that have come offline recently (where solar farms are being proposed to use the available grid capacity in place). There is a much bigger picture across the country that is key to the sector and the overall nation as a whole.

Introducing the UK Solar Summit conference

All the issues above are central to the scope, topics, themes and presentations lined up for the first live UK Solar Summit conference in London on 14-15 September, 2022. In many respects, the timing of the event could not be more pertinent.

In the 12 years I have been tracking and analysing the UK solar industry, I have never come across a point where massive investments were being lined up across both rooftop and ground-mount segments, eager to deploy as soon as possible, and (with the exception of the CfDs) in the absence of lucrative government incentives (as was the case with FiTs and ROCs before). If ever there was a time to understand the dynamics at play, it is now.

The UK Solar Summit conference could almost have been called the same at the headline of this article: Unlocking and deploying £25-30 billion to propel UK solar capacity to 40GW-plus by 2030. This is what the event is all about. It has been structured to hear from the leading stakeholders across the value-chains for new commercial/industrial rooftop PV and ground-mounted PV capacity set to be deployed in the next seven years.

Complementing this invited speaker line-up are various session and panel discussions that also capture new and innovative solutions being implemented to optimise, facilitate and improve all steps involved in building new solar capacity and delivering this effectively to the grid and other PPA off-taking entities.

Let’s have a quick look now at some of the highlight sessions that will take place over the two days of the event on 14-15 September 2022.

Starting off the event on the morning of Day One (14 September 2022) is the main keynote opening presentation session titled: Solar as a fundamental component of the UKs energy supply mix: opportunities and challenges in delivering this goal. This session will hear from probably the two most successful companies behind the UK getting to its current deployment level today, Lightsource BP and Anesco. Collectively, these two companies have set the benchmarks for successful and responsible solar farm deployment in the UK, and each remains fully committed to the domestic market with exciting plans going forward. Rounding out this session, I will give an extended presentation outlining further details on all the themes discussed in this article and many of the other analyses I have written and spoken about over the past few years as the industry rebuilt itself post-subsidy.

The main session focussed on commercial and industrial rooftops is also happening on Day One: Commercial & industrial rooftop PV: Building out the sector to reach the GW level. Here, we have invited two of the market-leaders today in the UK for rooftop solar installations, each with a very different business model and segment focus, but collectively highlighting that the rooftop space is comprised of various stakeholders today.

First, we will hear from BeBa Energy, a rooftop developer/installer that has successfully carved out a successful business before, during and after subsidies were on offer, and whose approach is based on focusing on a specific rooftop sub-segment. With a different business model, Eden Sustainable Group has been one of the most active rooftop players across the whole of England in the past couple of years, partnering with a broad range of stakeholders in the public/private and commercial sectors, and covering rooftop sizes typically anywhere in the 100kW to about 2MW range. Today, it is key to understand the different approaches to unlocking rooftop deployment in the UK, and this session is very much about hearing some of the success stories in the market now.

An event today focused on building new solar PV rooftops and ground-mount sites must include a highly-informative session on solar modules. The UK Solar Summit addresses this issue head-on. The final Day One session will look at module technology evolution over the next few years, benefits in yield (issues such as bifaciality and the use of trackers), and key issues that are causing the most concerns globally right now: module pricing, availability and manufacturing component supply-chain traceability.

This is the other session in which I will give a detailed presentation. Every day now, I get constantly asked about module pricing trends, supply lead-time problems, and how to understand which module suppliers have a sustainable component supply chain. I will focus my talk on these three issues, and try to explain how module buyers can get to grips with some of the most critical issues ever to emerge in the solar industry.

Day Two (15 September 2022) also features a host of sessions (presentations and panels) that address co-location (in particular energy storage solutions), new approaches by some of the most active EPCs in the UK solar industry this year, and the challenges of deploying capital to develop new sites and bring in capex for the build stage.

But perhaps the most important session of Day Two is titled: Large scale solar out to 2030: NSIPs, CfDs and Scottish/Welsh government planning. Here, we will debate factors critical to realising large-scale solar deployment at the ‘mega-solar’ level and show that some sites are well on their way to being built; as well as revealing new sites waiting to join the decision-making queue. Opening this session is perhaps the UK’s expert in solar NSIPs today; Gareth Phillips of Pinsent Masons.

Phillips has spoken on this topic extensively, and often alongside me at our webinars online in the past two years, and it is great that he will be live in person here talking about a rapidly evolving trend in UK solar that is now being prioritised by the government as ‘nationally significant’.

There are still opportunities to join our set of speakers and panelists at the event, so definitely reach out to us as soon as possible to discuss options. The venue is also filling up fast, so if you would like to attend and network with the rest of the industry, follow the links at the event landing page. The UK Solar Summit site and contact information can be found at the link here. I look forward to seeing as many of you as possible in September in London!